Best practices for GST compliant invoicing

Table of Contents

The implementation of GST has been one of the biggest tax reforms for businesses in India. Businesses have had to register themselves for GST if they are in the GST bracket. They have had to revamp their invoicing, record keeping and reporting of sales and purchases. Even though GST was launched in 2017, businesses still need guidance to comply with GST rules and regulations.

Below we have compiled a guide on how to create GST compliant invoices. Invoicing is a fundamental building block to achieve GST compliance for any organization.

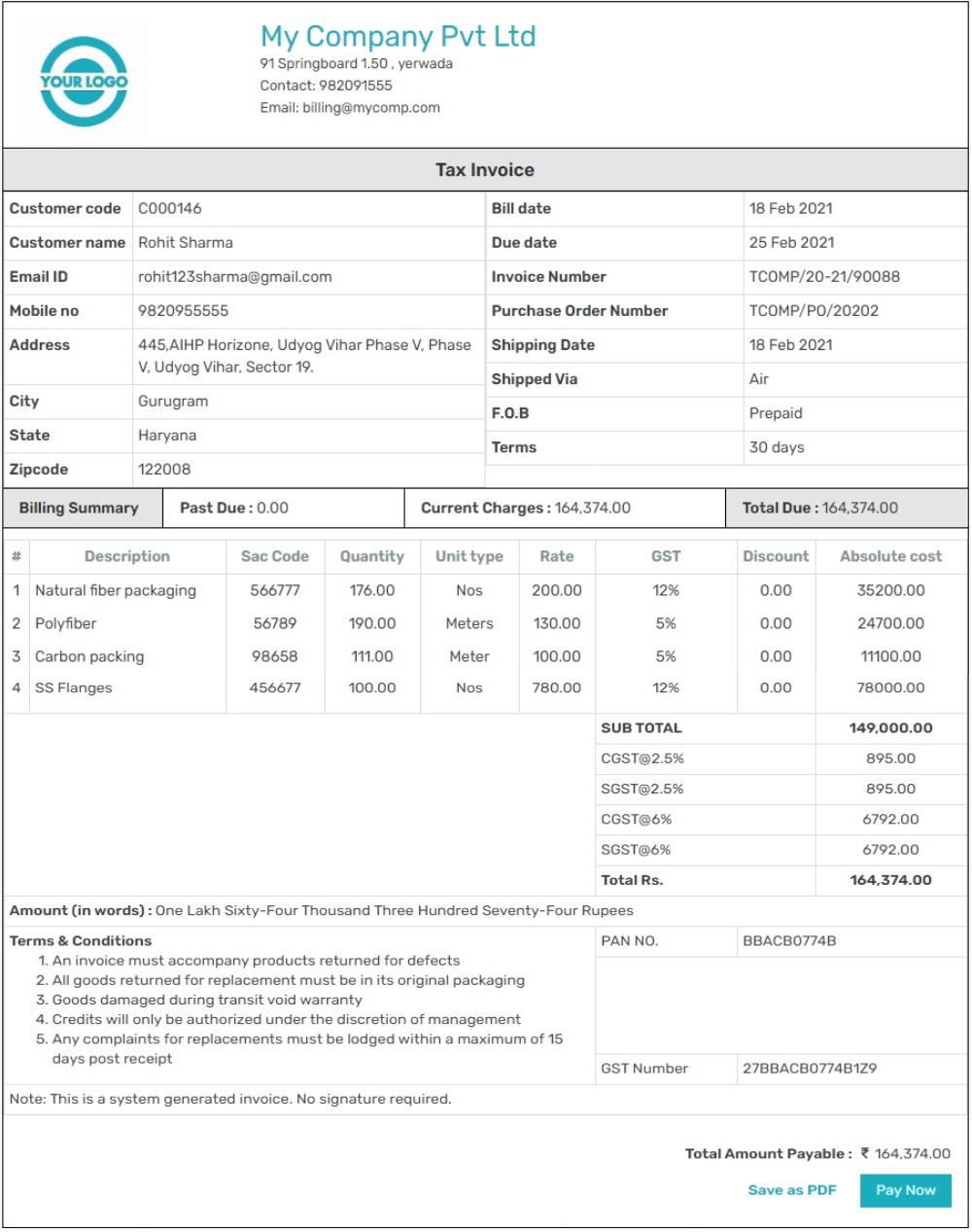

Structure of a GST compliant Invoice

Download this invoice in PDF format and see what your businesses GST compliant invoice will look like. You can also download and Excel format of this invoice that you can use to create GST invoices for your business.

Company information

The header section which is the top most portion of your invoice is usually the standard placement for all of your company information. This section should contain your business name, business address, business contact information such as your email address along with contact numbers and also your logo which is not a GST norm but a must have for your company branding.

Document type

This section is used to define the type of document you are generating for GST compliant invoices. This section should state clearly that the document is a Tax Invoice.

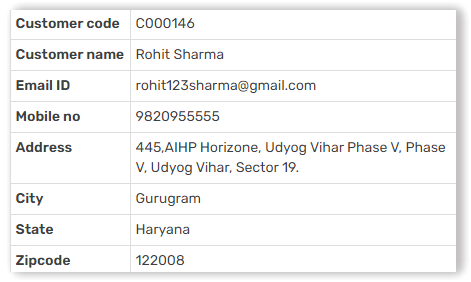

Customer details

This section is usually reserved for your customer information (The entity that is purchasing your goods or services) such as your customer code, buyer's company name, point of contacts name, registered address, buyers contact details which include their email along with contact numbers and most importantly their GST number.

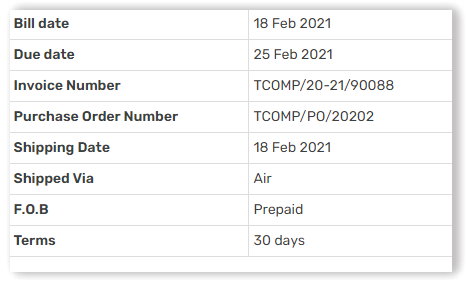

Billing details

The section alongside your customer details should contain all your billing details. Here you should have an invoice number which should be sequential as this is a basic norm of GST compliant invoices, invoice date, place of supply and due date for the invoice. You can also add details such as purchase order reference numbers, shipping details etc. This section should be clearly defined as this is one of the most important criteria while tracking and reconciling GST invoices.

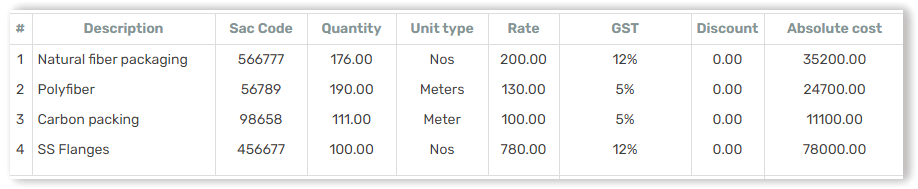

Product / Service details

The middle section of the invoice should be where you list all the relevant details of your products or services that were supplied. You should clearly mention the name of the product or service, information such HSN or SAC code, quantity, unit type, unit rate, GST applicable on each item, discounts or adjustments if any and the absolute cost. You can also add a small narrative section where you can provide a written description or comment for any of the goods or services provided. Good billing software usually has a product master where you can input all your products or services with all the above mentioned details, so when you need to generate an invoice you can select the product or service and all the other details will automatically be entered.

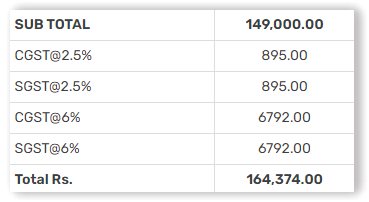

Taxation Summary

As per the GST norms in India it is mandatory to display a full break up of taxes such as CGST, SGST or IGST, total taxable amount after all the discounts and adjustments. A tax master should have all these predefined tax values ranging from 0% to 18%.

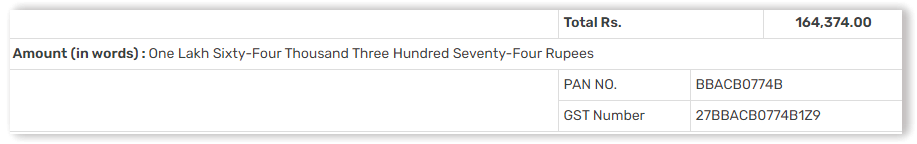

Total amount and Tax details

Post the tax summary the absolute cost of the invoice should be clearly mentioned with all taxes, discounts and adjustments taken into consideration. Just below this section is where you can also add your GST number, PAN card number to make this a valid GST invoice.

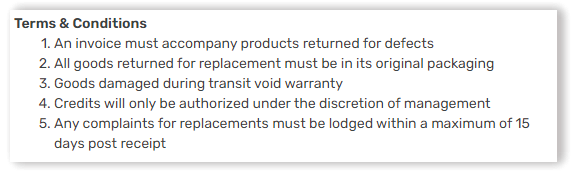

Terms & Conditions

This section is usually placed at the bottom corner of an invoice. It should clearly state payment terms, late payment penalties and banking details.

Signature

In today’s era of electronic invoicing most invoices do not have a physical signature but a disclaimer stating that the invoice is electronically generated and no signature is required. However a few businesses prefer a signature as it instills a sense of confidence in the buyer. Some industry types also require authorized digital signatures for a valid invoice.

GST Invoice Rules and Guidelines

- Issue a Tax Invoice for all taxable goods and services sold, if your business is registered for GST

- Issue a Bill of Supply in case you are registered under Composition Scheme

- Make sure you number all your invoices in sequential series , invoices that have been cancelled or refunded , credit and debit notes should all be maintained for accurate filling

- Makes sure your GST invoices contain your name, address, place of supply, GSTIN to make it a valid GST invoice

- Same state sales: CGST and SGST should be equally charged. For example, If the corresponding GST rate is 18%, CGST is 9% and SGST is 9%

- Interstate sales: For any sale outside the state of your business, IGST has to be charged. For Example, If you supply services with 18% GST from Maharashtra to any other state, you have to charge IGST at 18%

Best practices for invoicing

- Clear invoice design: do not make your invoice too cluttered with multiple line breaks and tables. Make sure your invoice is easy to read and takes your buyers eyes to the important information rather than making them comprehend a cluttered design. This will help you in getting paid without delays.

- GST compliance: The essential guidelines provided above should be followed to a tee to make your Tax Invoice valid.

- Colors and logo: Long gone are the days of the dot matrix printer, modern billing solutions allow you to add colour and vibrancy to your invoice along with adding your logo. This does not only help in readability but also allows you to show your businesses branding.

- Records : Maintain records of every tax document you create and ensure that they have accurate details to make sure your business stays GST compliant.

- Accurate GST information: Ensure that you are charging the right GST for your buyer. CGST and SGST for same state buyers and IGST for buyers from a different state.

- Filing : ensure you file your GST return in a timely and accurate manner to avoid penalties. This does not have to be a costly task as there are many softwares available that automate your GST invoicing and filling available in all price brackets.

Download free professional invoice templates for your business. Impress your clients and get paid on time! Download invoice format

As seen here there is a lot of care and attention needed to create GST compliant invoices. A billing software like Swipez is perfect for GST compliant invoicing. Using a product like Swipez Billing software make sure you are GST compliant in your invoicing right off the bat. Go ahead and create a free account and start creating GST compliant invoices for your company.