6 best payment tools for small businesses in 2021

Until a few years ago, setting up of a payment solution was a time-consuming operational task. It involved a lot of documentation, verification, huge setup fees technical infrastructure and know how to implement. In digital India, implementing a payment tool for selling business has become an extremely easy task. The right payment tool makes it easier for your customers to pay for services or goods and for business owners to organize and track all their collection data. Nonetheless, most businesses struggle with deciding the right payment tool(s) for their businesses. Today, with an increase in mobile internet connectivity, drive for cashless payment systems and improved customer experience, modern payment tools are replacing traditional payment methods.

Such different tools are the need of the hour for any type of business as they carry a host of benefits along with them like:

- Provide you complete control over your collections and finances

- Replace traditional inefficient modes of payments

- Improve the customer experience.

- Are more secure.

- Provide access to real-time collections data

From the growing list of online payment tools in India here are the six best payment tools suitable for small businesses.

Bharat QR

The growing usage of smartphones and internet has led to the payments industry in India undergoing and experiencing a sharp surge in QR code-based payment solutions. Bharat QR has initiated a new way for merchants and customers to exchange funds using mobile phones, making it a preferred channel to expedite and grow electronic payments through their QR code based interface. This is a technology that may hold the key to expanding electronic payments in millions of small retail merchants.

Features:

- Low-cost infrastructure

- Remote management of merchants and customers

- Interoperable QR code

- Push based transaction

- No need to store any charge slip copy by merchant

PayTM

PayTM is a leader in the wallet space. PayTM wallet is a digital wallet attached to a gateway service. Therefore, collecting dues with Paytm gives good benefits to small and mid-level merchants. It also features payback options to attract consumer’s interests.

Features:

- Domestic/international Credit/debit card support: Master card, Visa debit card, Maestro, Amex, Discover, Dinners.

- No initial setup fees.

- Zero annual maintenance charges.

- Zero Annual business requirement .

- Merchant can utilize the Paytm benefits within 2 days of document submission.

- Payment integration process takes almost 2-3 days. In some cases, if all the documents are available on time and Paytm is done with the KYC, the service can be started within 24 hours.

Instamojo

Instamojo is one of the fastest growing platforms for SMEs (Small to Medium Enterprise). The platform is a full-stack transactional platform empowering merchants with simpler processes. You can simply create payment links, share with customers, and receive payments. Thousands of users are using it to collect payments for e-books, reports, tickets, tutorials, merchandise, invoices, services, and much more. It is different from other payment gateways in the way that it’s set up is free of cost and takes only two minutes. Some of the other key highlights are no annual maintenance cost, simple APIs, a free online store to sell items, and payment completion using links on Facebook, Twitter, WhatsApp, and SMS.

Features:

- Embed payment buttons

- Direct link sharing options

- Visual charts of payments

- Offers free tools for small businesses

Google Pay

Formerly known as Tez, it is a digital payment application or tool from Google. With Google Pay you can send money to friends, pay bills, buy online and recharge your phone. Google Pay works with your existing bank account, which means your money is safe with your bank. There's no need to worry about reloading wallets and you don't need to do any additional KYC (Know Your Customer) which is required for all the other applications.

Features:

- Customers can pay you by using a QR code, UPI pin, mobile number, bank account number, IFSC code, or audio QR code.

- Customers can use the cash payment option to securely transfer money to nearby Google Pay users, without having to share their private details.

- It has enhanced security that prevents hacking and other attacks on your bank details.

- Secure the app using fingerprint or Google Pin and the UPI pin secures each transaction.

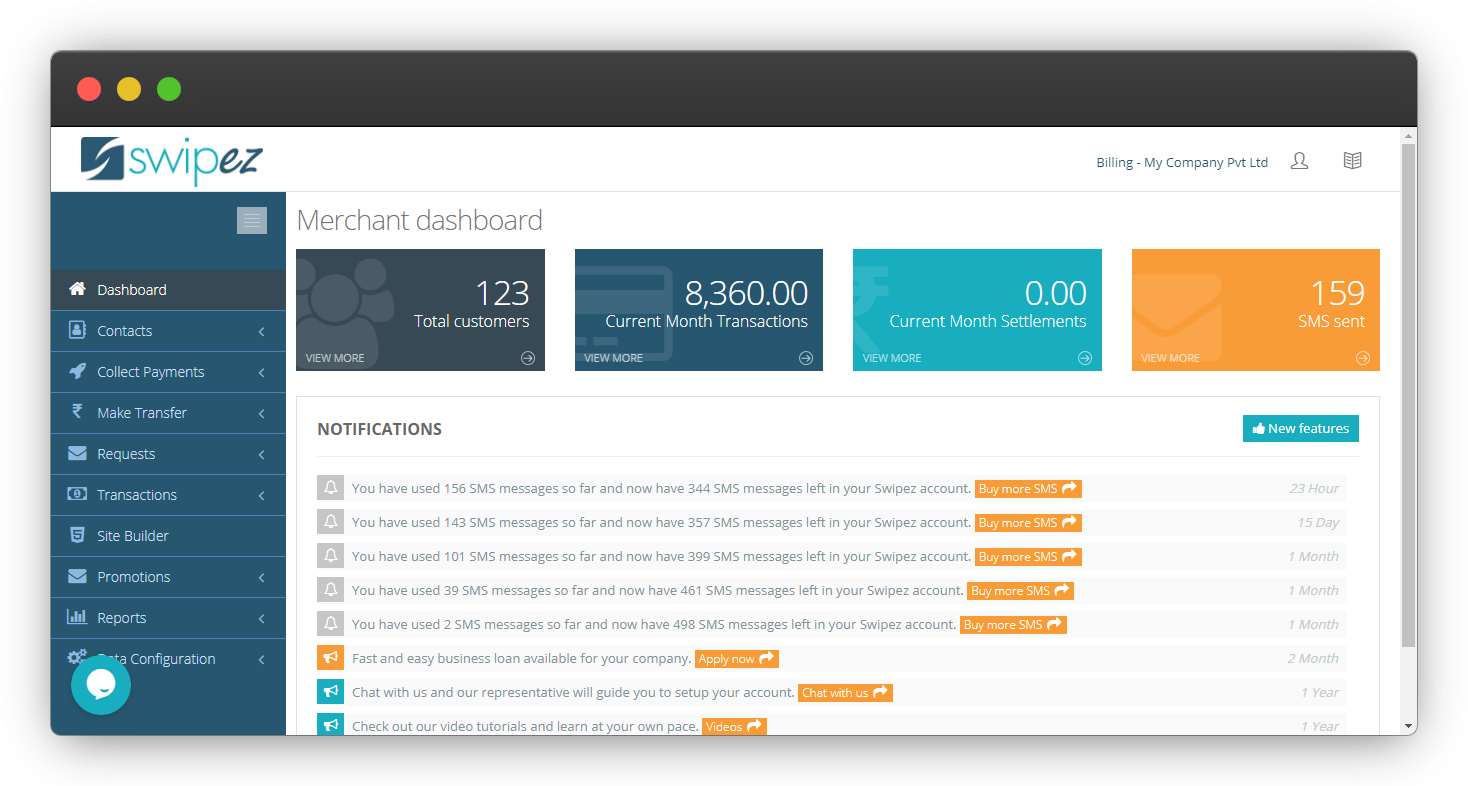

Swipez biling software

Swipez Billing Software is a complete solution for collecting payments which include sending invoices to customers via email and SMS, enabling online payments, receipt generation, reconciliation of online and offline payments, transaction analysis and a lot more. It streamlines business operations by automating invoicing, payment collections, bulk pay-outs, GST filing & customer data management.

Features:

- Automated payment reminders

- Recurring invoice

- Billing & invoicing

- Recurring billing

- Online payments

- Online payment process

- Recurring/Subscription billing

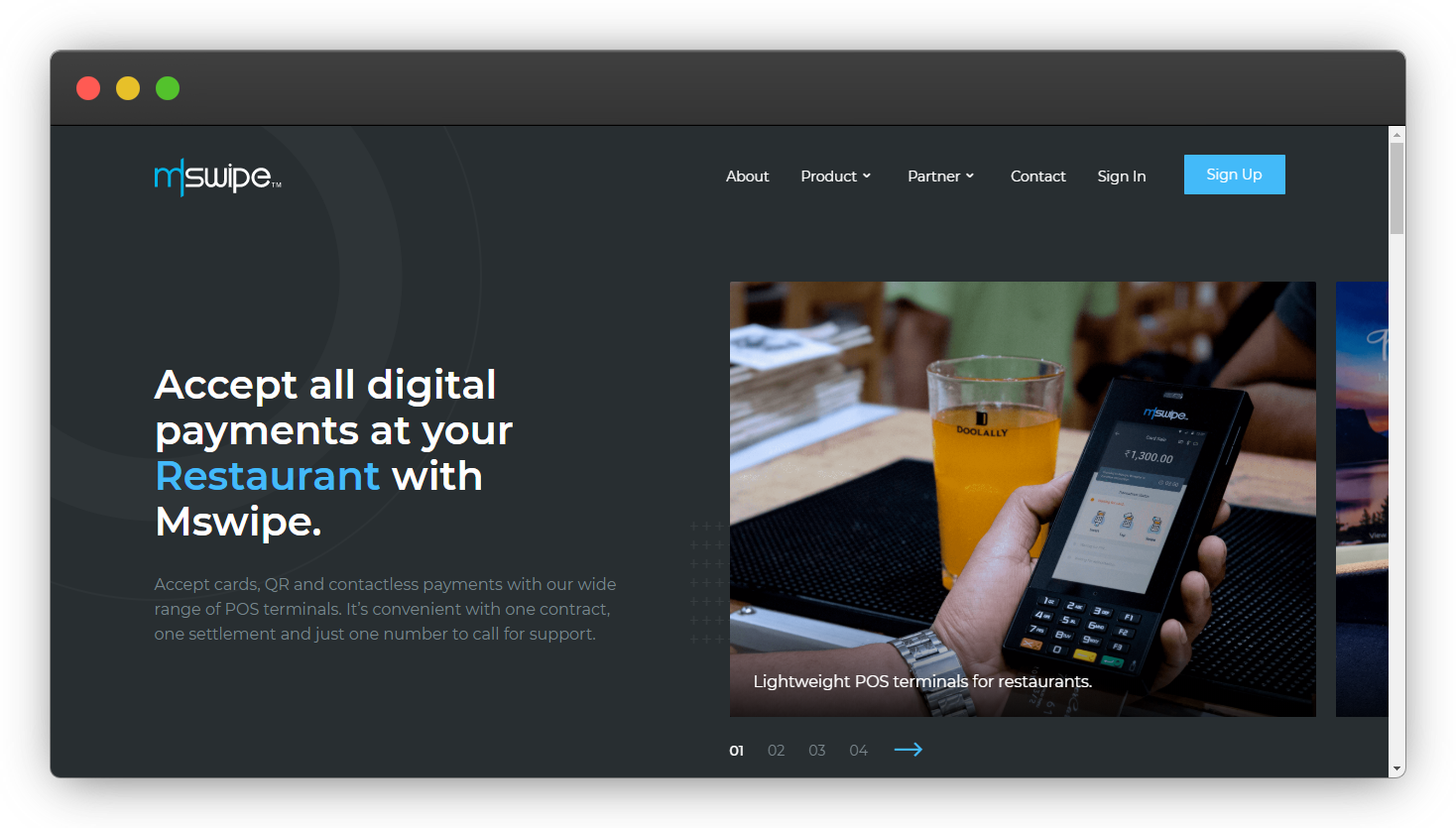

MSwipe

MSwipe accepts all kinds of payments including debit and credit cards, RuPay, Visa, MasterCard, and American Express. This e-payment tool is an affordable and effective solution and is approved by MasterCard mPOS with a certification from Visa Ready. It is considered to be a secure payment collection option. Mswipe users don’t need to open a separate bank account as the funds are transferred to your account directly via NEFT(National Electronic Funds Transfer). It helps avoid paper receipts by sending the transaction receipts directly on your customer’s mobile.

Features:

- Quickest way to accept small value transactions

- Accept payments from all mobile and banking apps

- Single QR supports all card brands

- Real-time transaction details

- Collect request feature enabled

- Money in your selected bank account

Bottomline

The whole payment solution outlook in India is changing rapidly. We now have many options to choose from to organise customer collections. The key is to choose a payment tool that suits your business needs and allows you to scale. The key aspects to look for before zeroing in on a payment tool for your business should include factors like integrations, payment modes, proactive customer support, and more. While making the final decision on which payment tool is best suited for your company integrate the one that suits your needs with keeping your target audiences in mind.