Union Budget 2022 Highlights for MSMEs

The Union Budget for FY22-23, the sixth parliamentary session since the COVID-19 outbreak in January 2020, brought with it a drive towards adoption of technology and digitization of the economy, along with a host of infrastructure projects.

The government's accounting of "This is the nation's income" and "These are the nation's expenses" for the upcoming year. An estimate of the revenue generated and likely to be spent in a financial year.

Don't tell me what you value, show me your budget, and I'll tell you what you value.”

― Joe Biden

What’s in store for small business owners?

- Additional loans for 13M MSMEs have been sanctioned with a total outlay of ₹2 Lakh Crores allocated to MSME development and schemes.

- Distressed companies with international assets heave a sigh of relief with plans to amend IBC, 2016. The efficiency of providing resolution to shareholders of companies that have international assets should increase post amendment.

The Insolvency and Bankruptcy Code of 2016, has incidentally been amended 34 times since its inception.

- The Emergency Credit Line Guarantee Scheme(ECLGS) to extend another year, till March 2023. The cover has now been extended to ₹ 5 Lakh Crores.

Reportedly, ₹2.28 Lakh Crores have been disbursed to 95.2 Lakh borrowers under the scheme. Of which, 66% of the funds were disbursed to MSMEs.

- ₹19,500 Crore outlaid to encourage the manufacture of high-efficiency solar modules under the Production Linked Incentive (PLI) scheme. A step towards India’s ambitious aim to reach its 280 GW solar power goal by 2030.

Under the PLI, the Atmanirbhar Bharat initiative aims to create 6 million jobs in 14 different sectors.

- Drone Shakti, a new initiative launched under the Union Budget, 2022, aims to provide essential courses through application centres to upskill individuals and drone-related startups.

On the other hand, the maximum penalty for the use of an unlicensed drone has also been reduced to ₹ 1 lakh. Is it perhaps time to buy a drone?

- ₹ 2.37 Lakh Crore allocated for Minimum Support Price (MSP) direct payments. Payments outlaid to cover 1,208 Lakh metric tonnes of wheat and paddy from 163 lakh wheat and paddy farmers.

Minimum Support Price (MSP) is the basic cost or rate at which the government procures food grains from farmers.

Looking Ahead

- In preparation for the launch of 5G mobile services within 2022-23 by telecom providers, an auction for the 5G spectrum is scheduled for March.

5% of the yearly Universal Service Obligation Fund (USOF) receipts have been dedicated to enable affordable broadband and mobile service proliferation in rural and remote areas.

- The rate of GDP growth is expected to reach 9.2% in 2022-2023. The telecommunications sector with the rise of digital solutions and accessibility is predicted to contribute close to 8% to the nation’s GDP this fiscal year.

Gross Domestic Product (GDP), at its crudest definition, it is the calculation of how robust a nation’s economy is and how much it is worth. How does one calculate GDP? Take a value sum total of every single commodity produced in the country, like pencils, erasers, rubberbands, etc. And add to that every single service, such as doctors, couriers, clerks, etc. That is a nation’s GDP.

- Fiscal deficit projected at 6.4% of the GDP, going slow on the fiscal glide path. Especially in a year with multiple high capital expenditure allocations.

In a year, if you make ₹10,000 but spend ₹15,000 rupees, you must borrow ₹5000 from a friend. The government receives revenue through taxes, interest, and other sources, but if they spend more, there would be a difference between their revenue and expenditure. Fiscal Deficit is the term for this disparity. In other words, it’s the government’s debt.

- The total expenditure in FY23 is expected to be ₹ 39.45 Lakh Crores. And the total domestic resource mobilization is estimated at ₹22.84 Lakh Crores.

Commonly referred to as DRM, it is the process by which a nation raises and spends its own funds. DRM funds or DRM expenses are allocated to deliver public services and work towards the alleviation of poverty.

Capital expenditure has seen a sharp hike of 35.40% from the previous allocation of ₹ 5.54 Lakh Crore to ₹ 7.50 Lakh Crore. With effective expenditure amounting to ₹ 10.68 Lakh Crore, which would be 4.1% of the GDP.

Let's say you purchase a home. You may live in it, rent it out, sell it for a greater price, and so on. In simple terms, capital expenditure refers to the money spent by the government on revenue-generating facilities. This wide category includes schools, trains, railroad infrastructure, etc.

- The ₹ 100 Lakh Crore, PM Gati-Shakti project aims towards a ‘holistic infrastructure’ of multimodal communications with improvements planned for roads, railways, airports, ports, mass transit, waterways, and logistics infrastructure.

The budget accounts for a 15% expansion of the national highway network. Along with an expansion of the rail network from 2000 kms to 25, 000 kms under KAVACH and 400 new Vande Bharat trains in the next three years.

- The initial public offering (IPO) of Life Insurance Corporation of India (LIC) is anticipated within this fiscal year.

An Initial Public Offering (IPO) or stock launch is a public offering in which a company's equity is sold to institutional and retail (individual) investors. With LIC going public “shortly”, you could own stocks in a financial institution that has been a national stalwart since 1956.

However, with just two months till the fiscal year closes and with the filing of the government’s draft with SEBI (Securities and Exchange Board of India) still pending, this herculean task is fraught with obstacles.

- Of the capital outlay allocated to the defence services/assets acquisition, 68% has been assigned to the domestic defence industry. That's 12.8% more than the last budget’s allocation as per public statements from the Ministry of Defence.

Quite literally, capital outlay refers to costs associated with the acquisition of capital assets such as equipment. Along with expenses associated with the maintenance and renovations for those capital assets.

- ₹ 48,000 Crores allocated to build 80 Lakh houses in rural and urban areas under the Pradhan Mantri Awas Yojana scheme. While 2 Lakh Anganwadis to be upgraded with better facilities.

- ₹ 1,500 Crores have been apportioned to fund infrastructure and social development projects in the northeastern states of the country.

- RBI to launch its own digital currency (digital rupee) this fiscal year. With the use of blockchain technology the RBI intends to introduce a Central Bank Digital Currency (CBDC) for a cheaper and more efficient currency management system.

Regulations for the new digital currency, and how RBI intends to address concerns regarding money laundering and tax evasion, remains to be seen.

- 75 Digital banking systems to be introduced in 75 districts, by Scheduled Commercial Banks. All of the 1.5 lakh post offices across the country are to come under the core banking system in an effort to encourage financial inclusion. Access to and from post office accounts and bank accounts through net banking, mobile banking, ATM services have been planned.

- In an effort to help start ups and manufacturing companies cope with the pandemic-induced delays, the budget proposed an extension of the sunset provision by a year to 31st March 2024.

A sunset provision is a clause or or regulation that defines the expiration date of a scheme/law/plan. So, any SEBI regulations, schemes, or laws that a company operates with or under, will have a sunset clause. Post the sunset date, the wording covered by the clause will be null and void. For example, the sunset of the Union Budget, 2022 is 31st March, 2023. Extending a sunset clause is to make no changes and keep in effect the present regulations.

Budget 2022 impact on taxation for small businesses

- While there are no changes to the income tax slabs, taxpayers can file revised returns within two years of the assessment year in question.

Meanwhile, the tax deduction limit for both central and state government employees has been increased from 10% to 14%. This is in an effort to support state government employees with social security benefits and bring them up to par with central government employees.

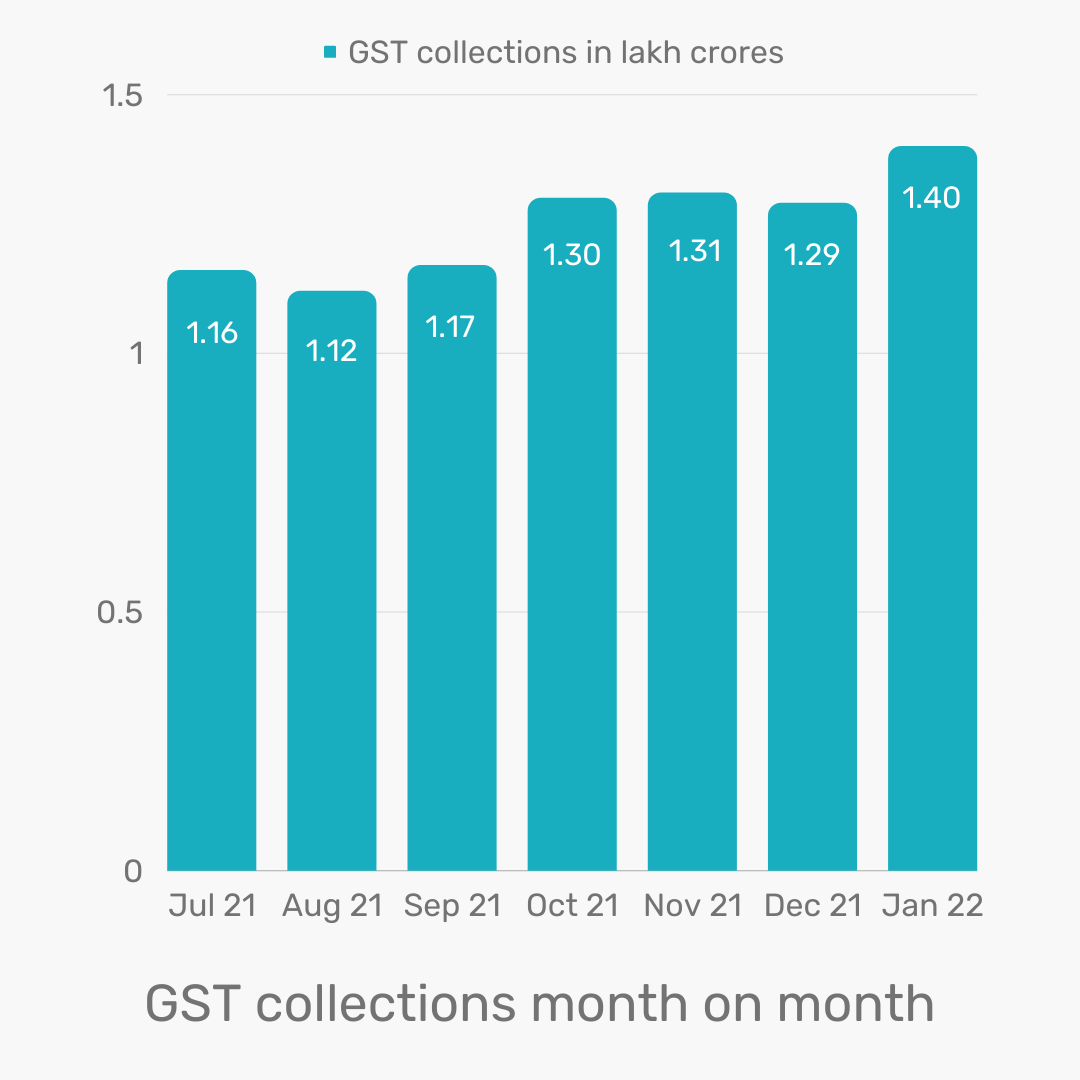

- GST collection for January 2022, climbs a record high of ₹ 1.40 Lakh Crores.

Gross GST collections have surpassed the ₹ 1 Lakh Crore mark for the seventh consecutive month.

- Corporate tax surcharge has been reduced from 12% to 7% for up to ₹ 10 crores. While a surcharge of 15% has been set for long term capital gains.

To know more about tax surcharge and marginal reliefs, read…

- The Alternate Minimum Tax rate for co-operative societies has been reduced from 18.5% to 15%. This is in an effort to provide co-operative societies parity with companies.

- While the duty on unpolished diamonds has been reduced to 5%, concessional duties on the import of capital goods will taper off over time.

- 100% tax exemption for startups on profits made in three consecutive years out of ten. The exemption will however be capped if the reported annual turnover exceeds ₹ 25 Crores in any fiscal year.

- 1% TDS to be levied on payments made towards cryptocurrencies worth ₹ 10,000 in a year. Any income generated from the transfer of digital assets is taxable at the rate of 30%.

While the 30% tax on gains will be effective from the start of the financial year, i.e., 1st April, 2022. The 1% TDS, however, will be levied from 1st July 2022.

For a more detailed report on the Union Budget, read...